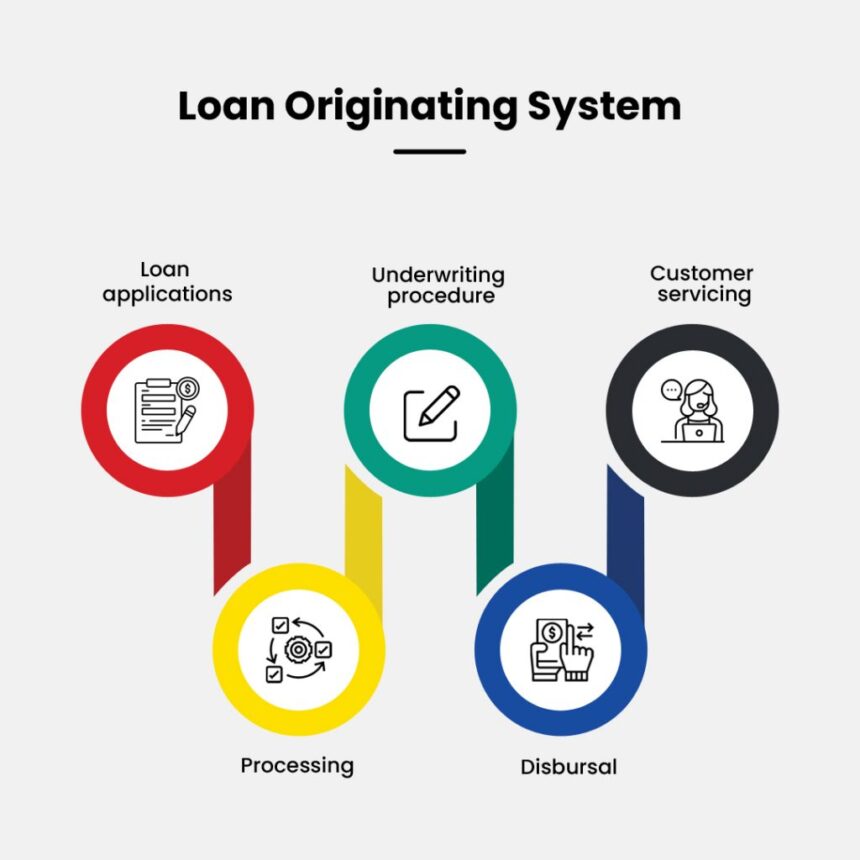

Banks and other lending institutions increasingly adopt specialized software to speed up loan origination operations. This change increases customer happiness and compliance adherence in addition to operational efficiency. The advantages, salient characteristics, and practical applications of loan origination software for banks—which have fundamentally changed the banking industry—will be covered in this essay.

The Need for Specialized Loan Origination Software

The standard process for getting a loan is a long, hard, and error-prone one with many steps and a lot of time. Processes like applications, screening, and approval all need a lot of work from people who pay close attention to every detail. In turn, this slows down the process and increases the chance of mistakes, which leads to angry customers and higher costs.

To get around these problems, bank loan processing software simplifies every loan application process step. By incorporating this software, banks may guarantee a more efficient, rapid, and precise procedure that satisfies the requirements of contemporary regulatory and consumer organizations.

Critical Benefits of Loan Origination Software

Here are some of the critical benefits of loan origination software:

- Efficiency and Speed: Automation speeds up the loan approval process by eliminating the need for human application and document processing. This efficiency is essential in a competitive market where clients need hassle-free, prompt service.

- Enhanced Accuracy and Compliance: The software’s integrated compliance checks and error-proofing measures significantly reduce the danger of non-compliance and operational errors. This is essential given the stringent restrictions that apply to the banking business.

- Improved Client Experience: Faster loan approvals result from a more efficient loan origination process, which directly raises client satisfaction. Furthermore, many systems include self-service portals so users can monitor the progress of their applications in real-time, increasing engagement and transparency.

- Cost Reduction: Banks may save labor costs and eliminate expenses related to mistakes and delays in the loan origination process by automating routine processes.

- Data analytics and insights: Banks can better identify risks and make more informed choices using advanced analytics capabilities. The service offering may be further improved by using these insights to customize items to the demands of the clientele.

Key Features of Effective Loan Origination Software

Let us take a quick look at some of the key features of an effective loan origination software –

- Application Processing: To streamline the application input, document upload, and preliminary data verification phases, the software should provide an intuitive user interface for bank employees and clients.

- Underwriting and Credit Assessment: Sophisticated algorithms evaluate application information based on various factors to determine credit risk. Decision-making is accelerated, and this automation increases accuracy.

- Workflow Automation: With customizable workflows that include automated alerts and escalations as needed, each loan application is guided seamlessly from one step to the next.

- Integration Capabilities: Good loan origination software ensures data integrity and accessibility by integrating easily with other financial systems, including CRM, core banking solutions, and compliance databases.

- Analytics and Reporting: Sturdy dashboards and reporting tools provide real-time insights into loan processing indicators, enabling banks to track productivity and make informed choices.

Implementing Loan Origination Software

Several crucial actions must be taken for loan origination software to be successfully implemented:

- Needs analysis: Banks must first evaluate their present procedures to determine which ones stand to gain the most from automation. This entails conferring with stakeholders from various departments inside the firm to guarantee that the software fulfills all essential needs.

- Selecting the Proper Vendor: Selecting the Proper Software Provider is Essential. Banks seek suppliers with a track record of success in the banking industry, vital customer service, and regular software upgrades.

- Integration and Customization: The software could need to be integrated with current systems or tailored to meet specific bank procedures. This step is essential to guarantee that the software operates well inside the bank’s IT infrastructure.

- Adoption and Training: Employees must get sufficient training on utilizing the program to be successful. Entire training guarantees that every user feels at ease with the program, essential for acceptance and usage.

- Continuous Improvement: Following installation, banks should routinely assess the software’s performance and make any required modifications. Utilizing new software features and upgrades while continuously optimizing procedures is made more accessible by this iterative approach.

Conclusion

The use of loan origination software has significantly improved bank loan processing. By automating and improving critical aspects of the loan lifecycle, banks may improve customer happiness, stay compliant with laws, and boost operating efficiency. Banks must now invest in specialized loan origination software to be competitive and adaptable to changing client needs as the financial landscape changes.