Key Takeaways:

- Understanding the importance of general liability insurance.

- Detailed steps on how to file a claim.

- Tips for a smoother claims process.

- What to expect after filing your claim.

The Importance of General Liability Insurance

General liability insurance is crucial for any business, covering a range of potential risks such as bodily injuries, property damage, and legal fees. Whether you’re operating a small bakery or a tech startup, having this coverage provides peace of mind and financial protection. A well-structured general liability insurance policy can shield your business from unforeseen circumstances, ensuring its longevity and stability. Many business owners find themselves in situations where a third party gets injured on their premises or property gets damaged. With the right coverage, these incidents can avoid significant out-of-pocket expenses.

Imagine a situation when a client trips and falls at your store, resulting in medical costs that, should they not have insurance, you may have to pay for out of pocket. Insurance acts as a safety net, preventing unforeseen circumstances from endangering the financial stability of your company. In addition to offering financial security, it also gives entrepreneurs peace of mind, enabling them to concentrate on expanding their companies rather than worrying about possible liabilities. This psychological security is priceless, particularly in the litigious environment of today.

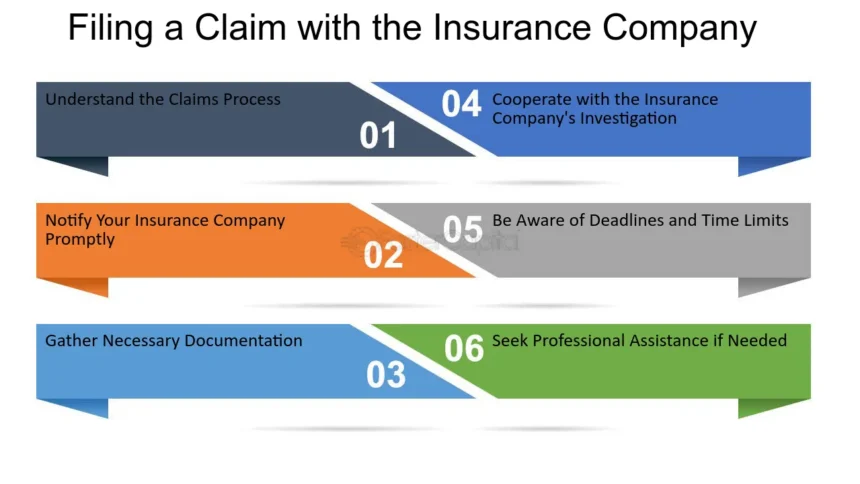

Steps to File a General Liability Insurance Claim

Incident Documentation

The first step in the claims process is to document the incident as thoroughly as possible. Take photographs, gather witness statements, and collect any other relevant information. Documentation is critical as it provides the necessary evidence to support your claim, making it more likely to be processed quickly and favorably. Ensure that you keep all receipts, invoices, and other records related to the incident.

Proper documentation serves as the backbone of any successful claim. You can create a strong case by capturing clear photographs from multiple angles and recording detailed witness accounts. Additionally, keeping a detailed log of all events and expenses related to the incident can be invaluable. This log might include timelines, communications, and any remedial actions taken. This evidence comes together to paint a clear picture for your insurance provider, reducing the risk of disputes and delays.

Notify Your Insurance Provider

Contact your insurance provider immediately to notify them of the incident. Most policies require immediate notification, and delays can complicate your claim. Provide all the records and information that were acquired about the occurrence. To make this procedure easier, several providers provide online tools for submitting claims or round-the-clock hotlines.

Timeliness is key in the notification process. Delays can hinder the prompt processing of your claim and lead to potential denials if the insurer believes the delay complicates their investigation. Be brief but informative when informing your provider. Write a summary of the event, draw attention to any important aspects, and make sure that the documents you have gathered are sent. Establishing open lines of contact with your insurance provider early on will facilitate a transparent relationship and speed up the claims process.

Complete the Claim Form

Your insurance provider will require a completed claim form. Be accurate and thorough when filling out this form. Include all details about the incident, damages, and any expenses incurred. Incomplete or erroneous information can delay the processing of your claim. Ensure you attach all required documents, such as photos, witness statements, and receipts.

Completing the claim form with precision is crucial. Double-check every detail before submission. Incorrect or incomplete forms can lead to multiple back-and-forths, prolonging the entire process. Take your time to ensure that every section is filled out correctly. If in doubt, consult with a representative from your insurance provider for guidance. Additionally, always keep copies of everything you send for your records, ensuring you have a backup in case any information gets misplaced.

Work with a Claims Adjuster

An insurance adjuster will be assigned to your case upon the submission of your claim form. The adjuster’s job is to look into the claim, confirm the details given, and ascertain the level of obligation of the insurance company. Be ready to respond to subsequent inquiries and, upon request, to give more documents. Cooperation with the adjuster can expedite your claim.

Working with an insurance adjuster involves maintaining open lines of communication and being responsive to their inquiries. The more promptly you can provide any requested documentation or clarifications, the faster your claim can proceed. Building a professional rapport with the adjuster can also be beneficial, as they are more likely to advocate for your claim if they see you as cooperative and transparent. Finally, always ask for a written summary of any meetings or inspections conducted by the adjuster to ensure clarity.

Tips for a Smoother Claims Process

Filing an insurance claim can be daunting, but following these tips can make the process smoother:

- Keep Organized Records: Maintain a file with all documents related to the claim, including correspondence with your insurance provider.

- Be Prompt: Notify your insurer and file the claim immediately after the incident.

- Stay Honest: Provide accurate and honest information throughout the claims process. Misrepresentation can lead to denial.

- Follow Up: Regularly check the status of your claim and respond promptly to any requests from your insurance adjuster.

Organized records serve as a central repository of all essential documents, helping you track the progress of your claim effectively. Being prompt ensures compliance with policy requirements and accelerates the overall process. Honesty in all communications builds trust with your provider, reducing the likelihood of disputes or complications. Regular follow-ups demonstrate your commitment to resolving the claim swiftly and efficiently.

What to Expect After Filing Your Claim

Once you have filed your claim and provided all necessary documentation, the insurance provider will begin the review process. This involves verifying the details of the incident, assessing the damages, and determining the settlement amount. The timeframe for this process can vary, but regular follow-ups can keep things on track. In the meantime, keep records of any additional expenses or developments related to the incident.

The claim can either be approved, modified, or denied. If approved, the insurance company will issue a payment for the agreed-upon amount to cover the damages. In cases where the claim is modified, the insurer may offer a different amount based on their assessment. You have the right to contest this if you disagree. If denied, the insurer will provide reasons for the denial. You can appeal this decision or seek legal advice if necessary.

The review process typically involves several layers of scrutiny. Initially, the claim is examined by the insurer’s internal team, followed by an in-depth review by the claims adjuster. Regular updates and transparent communication with your insurance provider can help understand your claim’s progress. Should any discrepancies arise, address them immediately to avoid further delays. It’s also wise to consult with a legal advisor if you believe the denial was unjustified, ensuring you explore all avenues for recourse.

Conclusion

Understanding the claims process for general liability insurance can save your business time and money during stressful situations. From documenting incidents to working with claims adjusters, being prepared can ensure a smoother experience. Ensuring your business is properly insured protects your assets and provides peace of mind. Taking proactive steps to understand and navigate the claims process can significantly reduce your business’s stress and financial burden.

In conclusion, investing in a comprehensive general liability insurance policy is crucial for safeguarding your business against unforeseen risks. By familiarizing yourself with the claims process and following best practices, you can confidently navigate potential challenges. Remember, a well-prepared business is resilient and capable of weathering any storm that comes its way.